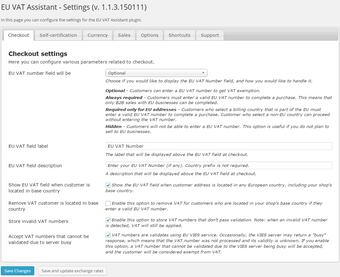

Comprehensive EU VAT Solution for WooCommerce

The WooCommerce EU VAT Assistant is a powerful free plugin designed to assist merchants in complying with the complex EU VAT regulations that took effect on January 1, 2015. This plugin automates VAT calculations based on the customer's location, ensuring that the correct VAT rate is applied to each sale. It collects and stores necessary evidence to validate customer locations, which is crucial for compliance with the new regulations. Additionally, it facilitates the preparation of VAT reports, simplifying the filing process for VAT/MOSS returns.

Key features include automatic validation of EU VAT numbers, support for multiple currencies, and the ability to generate detailed VAT reports by country. The plugin can also manage mixed products and services, allowing merchants to specify where VAT should be paid. Although the plugin is no longer maintained, it remains functional and is a valuable tool for WooCommerce users seeking to navigate EU VAT obligations effectively.